brownindian

Sixth Man

- Joined

- Nov 24, 2010

- Messages

- 4,542

- Reaction score

- 1,615

- Points

- 113

Thoughts ?

I think $15 is to high but obviously $7 is way to low. Start with a instant increase to $10, then mandate a 2.5% min increase each year. Its crazy how long its been since it was raised.

ahh the joys of middle middle management. taking it up the ass while being a mouthpiece for the guys who always make sure never to disclose their bottom line within meshing their salaries in with the rest.2.5% increase isn't reasonable either. There were years during the downturn that I didn't receive an increase, or went backwards in compensation. I imagine the same thing happened to you being in the mortgage business, but I could be wrong. You can't mandate an increase if the business can't afford it.

Employable adults don't make $7/hr. We can barely hire employable adults at $12 an hour without any skills.

If you raise minimum wage that much, the cost of living will go up and my wage won't, so I'll go from middle class to lower middle class. Fuck you, poor people. Get an education or a skill if you want more money.

money

money

ahh the joys of middle middle management. taking it up the ass while being a mouthpiece for the guys who always make sure never to disclose their bottom line within meshing their salaries in with the rest.

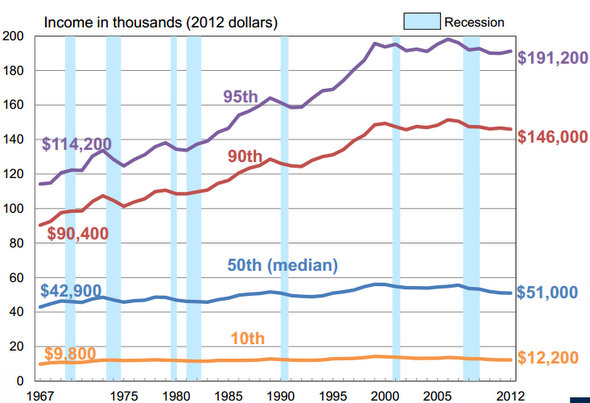

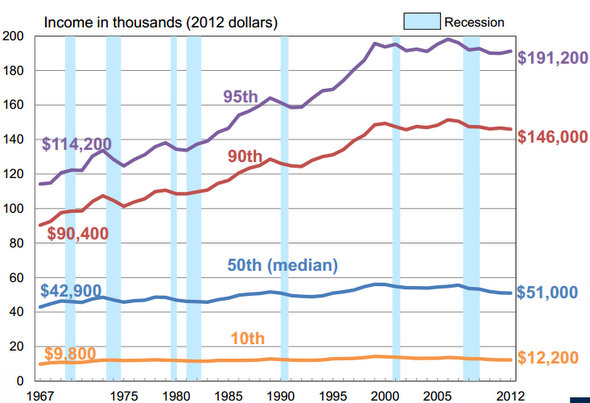

Nice concept , until you look into the past.. lets take a look at coal mining jobs, steel mills and other factory settings. These jobs wages have stagnated over the past 30 years.

despite a larger increase in workforce with most families now consisting of two incomes instead of one the buying power of these two income households is less than what one income households used to bring

http://economix.blogs.nytimes.com/2...ut-american-wages/?_php=true&_type=blogs&_r=0

http://www.epi.org/publication/a-de...-shared-prosperity-and-a-rising-middle-class/

http://money.cnn.com/2011/02/16/news/economy/middle_class/

what this chart shows is that now the stagnation is impacting the upper class.

I dont think raising wages alone address this problem but after 40 years its time something was done. and raising minimum wage readjusts the scale and forces companies to recalibrate how they distribute their wages.

now there are economist who have tried to dismiss these numbers by trying include the benefits workers have today but forgetting to adjust for the benefits provided back then as well as the overall medical cost in relation to those benefits.

meanwhile

This isnt about people working at Burger King or unemployable everywhere else.

really my salary went up 15 % the last wage increase. plus the standard increase.