I have like 60k, not sure how much I want to put where.

My dad said my aunt may be up for selling a 2/1 in Oregon for 200k, rental prices look like 1800/mo up there if this changes any calculus. I look at that math and I'm at even between rental vs mortgage so no profit, I'm just waiting for the home to appreciate. Not sure if prices are rising as quickly there, but if they are, 6% annually in 7 years does look decent

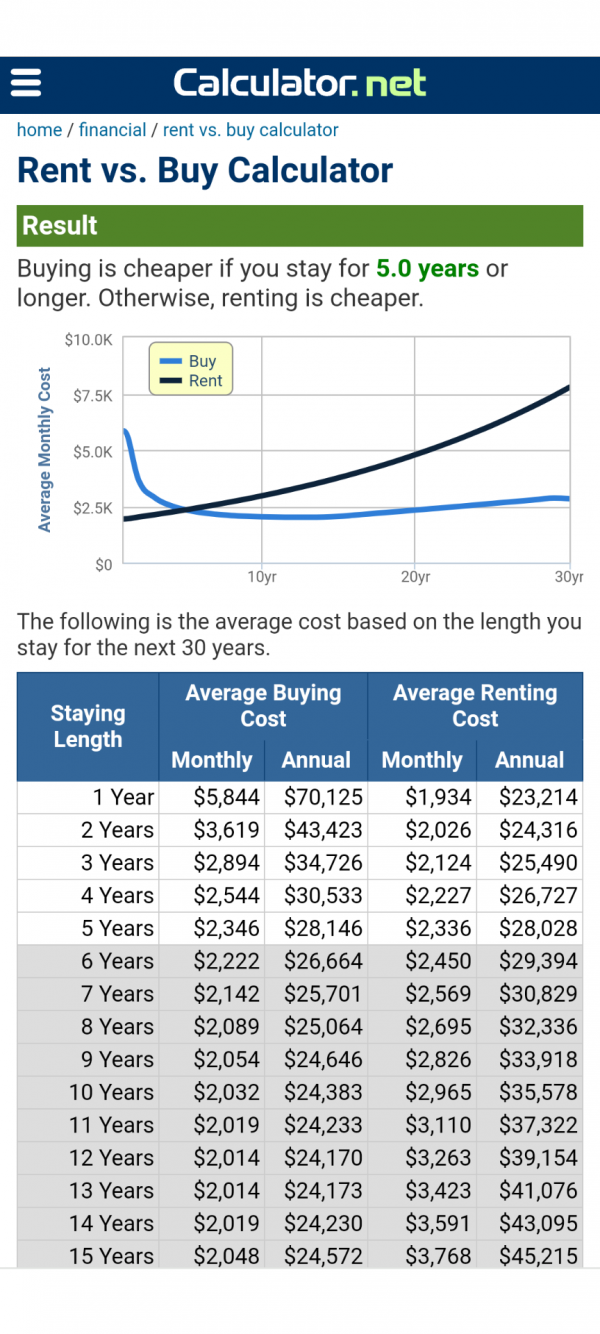

Used a rent vs buy calculator and it came up with this

View attachment 15734

Break even is 6 years from now?